What Dealers Need To Know About Used Car Prices In 2025

by Marsh Finance on Jan 21, 2025 4:31:39 PM

Key Summary

The used car market in 2025 is looking steady, which is great news for dealerships. Retail prices are levelling out, trade values are climbing, and cars are selling faster—about 33 days on average. It’s the perfect time to fine-tune your pricing and focus on stocking the cars people really want. By using tools like Auto Trader’s Retail Price Index and keeping an eye on trends, you can stay ahead of the game.

As 2025 gets underway, the used car market is showing encouraging signs of stability. For dealerships, this presents an opportunity to fine-tune strategies and make informed decisions about pricing and stock. Drawing insights from the latest Auto Trader data, we’ll explore the trends shaping the market and how understanding them can help dealers navigate a recovering landscape.

👉 Stabilising retail prices: a positive start

👉 Trade valuations: bridging the gap

👉 Understanding seasonal trends

👉 How Marsh Finance can support your dealership

Stabilising Retail Prices: A Positive Start

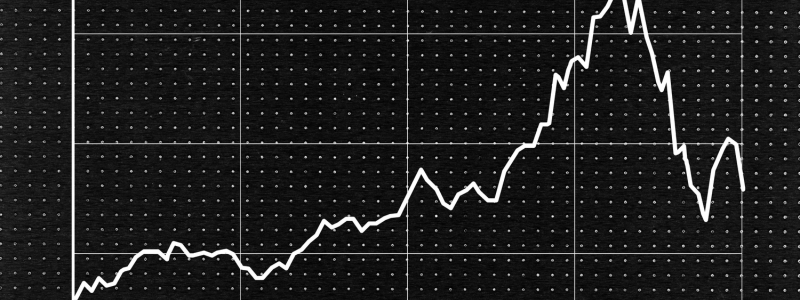

Used car retail prices have been on a steady trajectory, with December 2024 marking the sixth consecutive month of improvement. While prices were down 4.1% year-on-year, this reflects a recovery from earlier dips and aligns with typical seasonal trends, such as a modest 0.6% decline from November to December. These figures suggest a market that’s settling into a stable rhythm after a period of volatility.

For dealers, this stability means greater predictability when setting prices and managing margins. By staying attuned to monthly movements and benchmarking against tools like Auto Trader’s Retail Price Index, dealerships can optimise their pricing strategies to remain competitive.

Trade Valuations: Bridging The Gap

Interestingly, while trade values are increasing year over year, retail prices are still catching up. This widening gap offers dealers an important insight: understanding the dynamics between trade and retail valuations is critical. For example, younger vehicles (up to three years old) are experiencing distinct valuation patterns compared to older stock.

Dealerships that leverage this knowledge can make smarter buying decisions, focusing on stock with the highest potential for margin growth. Additionally, monitoring the alignment between trade values and retail prices can help manage expectations and avoid overpaying for inventory.

Understanding Seasonal Trends

December’s data also highlights the importance of seasonal context. Price movements across all fuel types, including EVs, were in line with typical seasonal fluctuations, emphasising the return of predictability in market behaviour.

This consistency allows dealers to plan ahead, whether it’s adjusting stock levels for peak demand periods or tailoring promotions to align with seasonal buyer preferences.

Faster Turnover, Smarter Stocking

Another standout trend from December is the speed at which used cars are selling. Vehicles turned every 33 days on average, three days faster than the same period last year. This faster turnover underscores the importance of stocking the right vehicles that align with current consumer demand.

With supply remaining constrained (down 5% year-on-year), competition for desirable stock is high. Dealers that prioritise data-driven stocking strategies focusing on popular models and trims will be better positioned to capitalise on this rapid market movement.

How Marsh Finance Can Support Your Dealership

At Marsh Finance, our financing solutions are designed to help dealerships thrive by making it easier to secure and sell stock that meets evolving customer preferences.

The road ahead in 2025 is looking steady, but it’s the dealerships that embrace data and act strategically that will lead the pack. Are you ready?

- Latest Car Updates & Advice (39)

- Car Reviews (25)

- Dealership Support (23)

- Industry Insights (21)

- Driving Test Advice (14)

- Car Insurance (8)

- Credit Score (8)

- Car Care & Maintenance (7)

- Car Tax (5)

- Christmas (3)

- Car Finance (2)

- Careers (2)

- Money Help (2)

- Company Updates (1)

- Partner Support (1)